CloudATM

An accessibility study and proposal for better ATM systems

Collaborators: Venkatesh Potluri ,Dr. Colin Scott.

Background

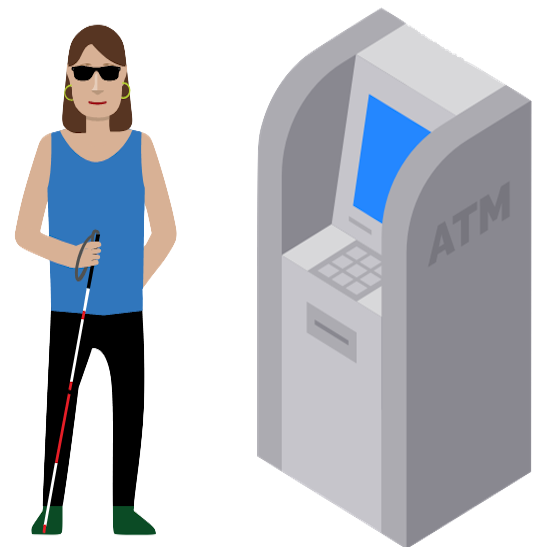

ATM machines and other banking services are not completely accessible to people with visual impairments. The Reserve Bank of India (RBI) which is a governing body mandates that atleast 33% of the ATM machines in the country be accessible to people with impairments. Sadly, the reality is no where close to the targets set by RBI.

Objectives

The aim of the project is two fold.

- To study the state of ATM accessibility in India.

- To propose new ATM transaction processes which are more accessible and usable by regular ATM users.

Stretch Goal

We aim to take our proposal and implement it to bridge the gap between policy and practice and make financial services more accessible to a wider range of people.

How it works?

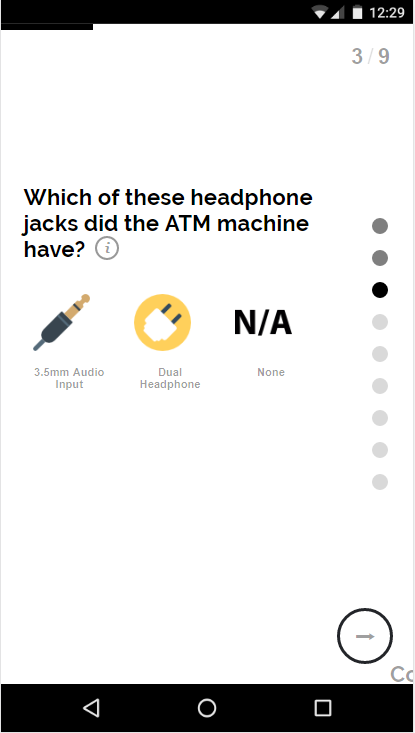

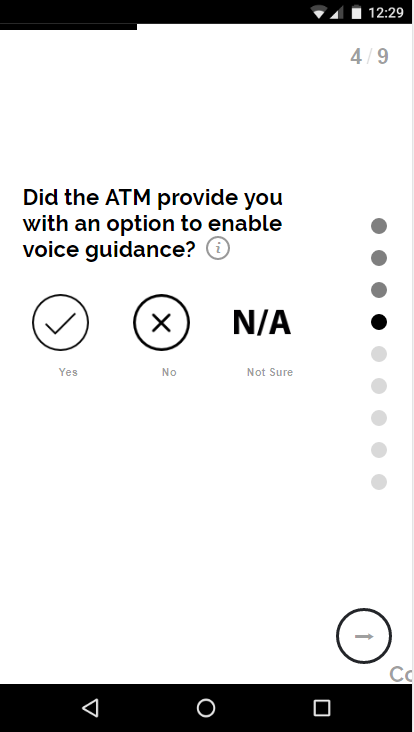

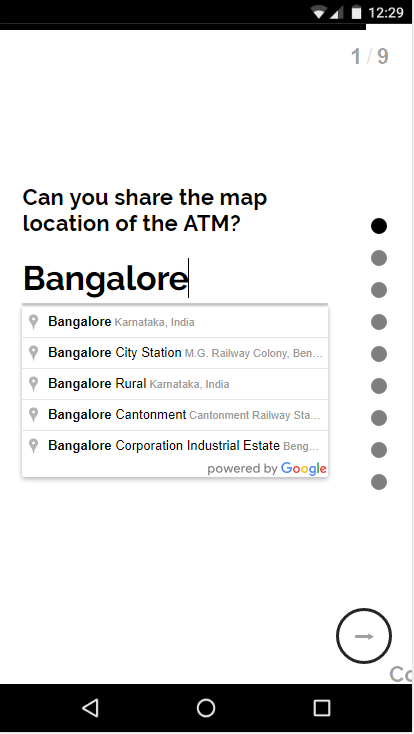

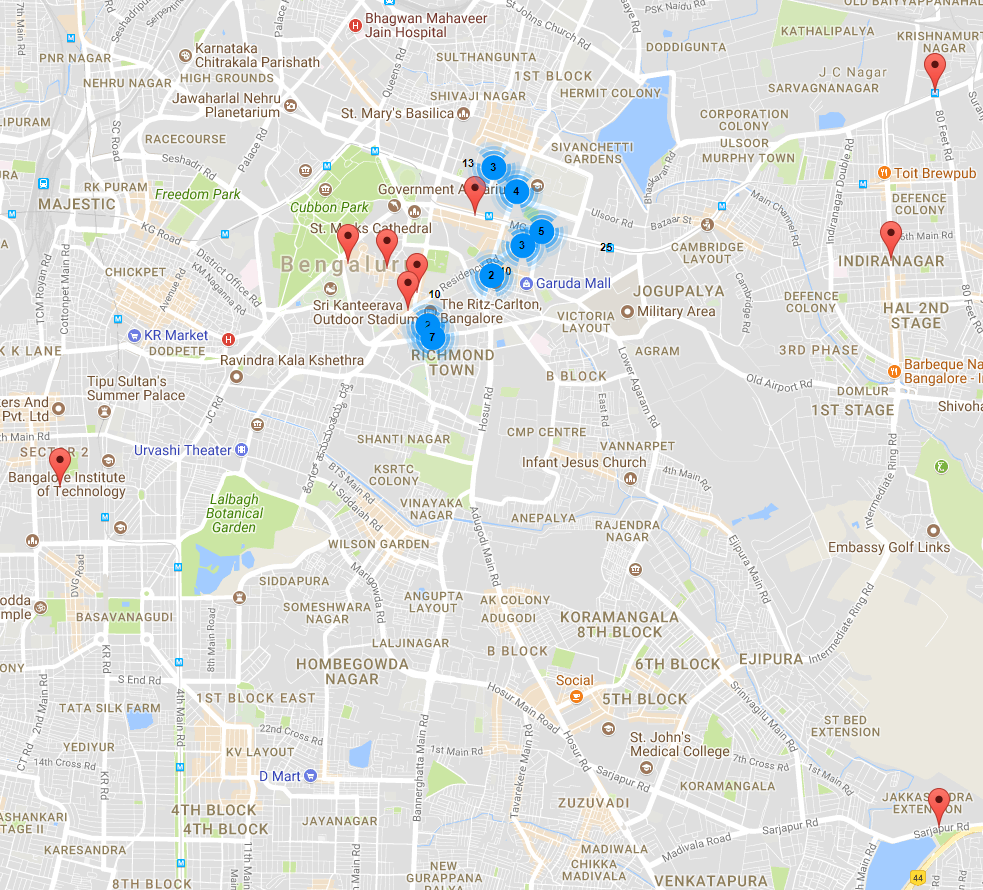

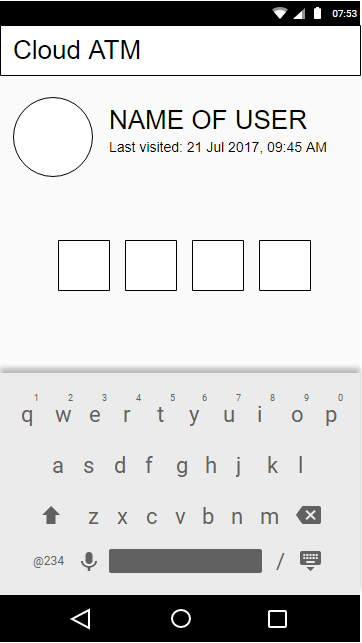

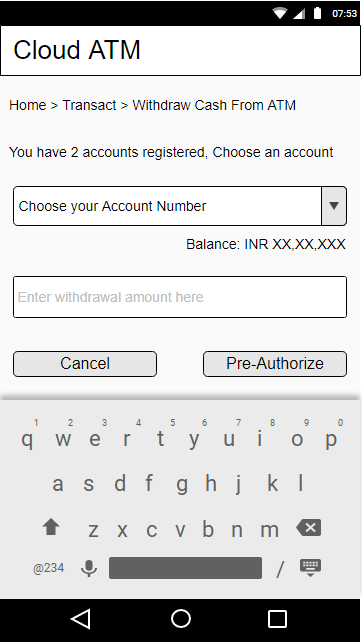

The initial part of the study involved building a custom data collection portal which allowed participants to crowdsource information of the ATMs and its accessibility status. This app was available as a webapp and a mobile app that the crowdsourcers used. The results from this study were used to propose CloudATM, a new procedure to perform ATM transactions from a mobile banking app. CloudATM uses the payment interfaces provided by NPCI called UPI which is a part of the IndiaStack that allows ATM machines in India to be identified by unique addresses and links to the user details present with banking databases to perform the required cash withdrawal transaction.

Using this system, we have been able to achieve the following:

- Reduce total transaction time / usage time at the ATM for all ATM users.

- Make the ATM systems more accessible by offloading the transaction to be performed from an accessible mobile app.